Image credit: iStock / Andrey Suslov

The price of bitcoin fell on Tuesday below the long-held technical support level of $30,000 to about $28,911 — its lowest since Jan. 28, while the combined value of the crypto market sank below $1.5 trillion over the past week, down from $2.5 trillion in May.

Technical analysts who study charts to make buying and selling decisions have been watching the $30,000 bitcoin level as a key support level ever since the May crash. Analysts believe the next level to watch for support could now be as low as $20,000.

Bitcoin could still rebound, but there’s significant downside to the next support level, said Galaxy Digital CEO Mike Novogratz on CNBC’s “Squawk Box.”

″We’ll see if ($30,000) holds on the day. We might plunge below it for a while and close above it. If it’s really breached, $25,000 is the next big level of support,” Novogratz said. “Listen, I’m less happy than I was at $60,000 but I’m not nervous.”

Here are six factors driving crypto prices down.

The bitcoin price dropped after Chinese regulators intensified a ban on crypto. The Chinese government announced on Monday that it has ordered banks to stop all virtual-currency transactions. China has also imposed new restrictions on energy-intensive bitcoin mining. After surging bitcoin prices brought fresh scrutiny to bitcoin’s massive environmental footprint, China sent data center operators an “emergency notice” telling them to report on their involvement in Bitcoin mining.

The Biden administration plans to strengthen tax compliance including a new set of Internal Revenue Service crypto regulations governing transfers. The goal is to combat tax evasion and mirror the rules policing cash transactions. Transfers of at least $10,000 in cryptocurrency must be reported to the IRS effective 2023, the U.S. Treasury said. Its report was released a day after the May 19 crypto crash, which saw bitcoin prices plunge as low as $31,926.

The Treasury announcement caught crypto dip buyers off guard. “Just in case you thought you were buying the dip, you were wrong,” Dare Obasanjo tweeted @Carnage4Life.

The market looks south with demand-side pressures weakening in the wake of regulatory fears and the Federal Reserve’s recent hawkish tilt, analysts told CoinDesk.

“There’s no direct evidence showing people in China are buying the BTC dip. As shown in the ChaiNext tether (USDT) OTC index, the value hovered at 99 for the last few weeks in June, which shows a slight discount in trading USDT,” said Matthew Lam, an analyst at crypto exchange OKEx.

When Tesla CEO Elon Musk made a U-turn on bitcoin, saying that he will no longer allow his company’s electric vehicles to be bought using the cryptocurrency because of environmental concerns, hundreds of billions of dollars were wiped off the entire cryptocurrency market within three hours.

Cambridge University researchers created an online tool that estimates bitcoin electricity consumption. The Bitcoin Electricity Consumption Index shows that bitcoin consumes about 124 Terawatt-hours per year — about a half-percent of the world’s total consumption and as much as Pakistan’s.

Other estimates are higher. Testimony presented to the U.S. Senate Committee on Energy and Natural Resources in August 2018 claimed that bitcoin mining accounts for 1 percent of the world’s energy consumption, The Balance reported.

“Bitcoin is deeply colonial, deeply extractive, and deeply damaging to the environment and marginalized people around the world,” wrote Eric Holthaus, founder of The Phoenix, a newsletter about frontline communities and voices enduring the climate emergency. “This privileged crypto-colonialism almost exclusively benefits white men and it’s happening at a moment when the escalating climate emergency is causing escalating chaos that better deserves our electricity and our attention.”

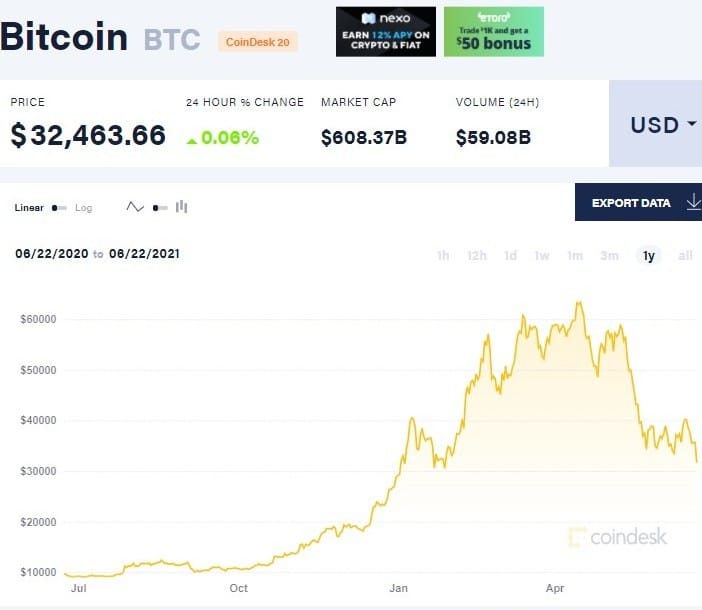

Bitcoin has lost more than half its value and all of its 2021 gains over the last two months, between its record high near $65,000 in April and today, June 22, 2012. Bitcoin started 2021 at $29,333 and its price fell briefly to $28,911 on Tuesday.

One of the speculative risks associated with bitcoin is that no one knows who created it. “There are some suspicions out there that it was created by the U.S. government, by an agency like the NSA (the National Security Agency, part of the U.S. Department of Defense” said Jamarlin Martin, CEO of The Moguldom Nation, in Episode 74 of his GHOGH podcast, broadcast on April 11, 2021.

“Of course the pumpers and the cheerleaders of bitcoin, they act like this is a people thing,” Martin said. “The people created bitcoin and it’s for the people to go against the government. So they want to frame Bitcoin as … you’re banging on the government. Bitcoin against the government … it’s going to help these countries and help poor people.”

Another speculative risk of bitcoin is its support among the casino gambling-type investors, Martin said. If those investors become a dominant factor for Bitcoin, “that’s a risk factor because if the market starts to turn, this hot money is going to be rushing for the exit. They’re going to try to all be getting out the door at the same time. So this could set up a collapse of bitcoin of 50 percent or more.

“If you’re holding Bitcoin for the long term, you have a lot of conviction. That’s fine,” Martin said. “But if this hot money, speculative money … is really, really deep in the market structure of bitcoin, it’s a risk to that asset.”

Listen to GHOGH with Jamarlin Martin | Episode 74: Jamarlin Martin Jamarlin returns for a new season of the GHOGH podcast to discuss Bitcoin, bubbles, and Biden. He talks about the risk factors for Bitcoin as an investment asset including origin risk, speculative market structure, regulatory, and environment. Are broader financial markets in a massive speculative bubble?

A technical indicator called the “death cross” has ominous implications for Bitcoin, suggesting that bearish sentiment is building as bitcoin has failed to recover from the May 19 market crash. The death cross is a technical chart pattern indicating the potential for a major sell-off. It appears on a chart when a stock’s short-term moving average crosses below its long-term moving average. Typically, the most common moving averages used in this pattern are the 50-day and 200-day moving averages.

Bitcoin charts show the 50-day moving average has fallen below the 200-day moving average, Coindesk reported. Coinbase co-founder Fred Ehrsam has warned that “most” cryptocurrencies and crypto-assets “won’t work” and “90% of NFTs” will have “little to no value in three to five years,” Forbes reported on June 20.

Lebanese-American bestselling author and former options trader Nicholas Taleb is frustrated and skeptical about bitcoin, saying in a tweet that it’s “a magnet for idiots.” A one-time admirer, Taleb has denounced the world’s No. 1 cryptocurrency as a gimmick that resembles a Ponzi scheme. Taleb tweeted, “A currency is never supposed to be more volatile than what you buy & sell with it. You can’t price goods in BTC.”

Taleb and Michael Burry, who called the 2008 real estate bubble and crisis, have pressured market sentiment with critiques of the speculative bubble. Burry, the hedge fund manager who made hundreds of millions of dollars betting that the U.S. housing market would crash and helped inspire the best-selling book, “The Big Short,” recently described what’s going on in the markets as the “greatest speculative bubble of all time in all things by two orders of magnitude.”

As bad as the subprime mortgage crisis was, this bubble is bigger, Burry said. He also predicted that the GameStop shares would skyrocket.

During the run-up in prices this year, bitcoin went up as much as 10 percent or more on various pump headlines from MicroStrategy CEO Michael Saylor and Tesla CEO Elon Musk. Their companies are the two largest publicly traded corporate holders of Bitcoin. Some traders say the CEOs have tried to pump the cryptocurrency and manipulate its price to avoid going underwater and be forced to sell. Saylor has announced multiple large bitcoin buys but prices have kept trending down from a high of close to $65,000.

“The bitcoin price, after getting an unexpected boost from Tesla billionaire Elon Musk … has resumed its decline over the last few days, falling back toward $30,000 per bitcoin,” Billy Bambrough wrote for Forbes.

Image credit: iStock / Andrey Suslov